Hotel Charge (Handling Fee) Follow

Hotel Charge is a Dubai-client specific issue (though similar concepts may appear elsewhere).

There are only two alcohol suppliers in Dubai:

- African & Eastern (A&E)

- Maritime Mercantile International (MMI)

Most of our clients aren't allowed to directly purchase alcohol from A&E and MMI, because of the rules in the UAE requiring a license (which costs money) to purchases alcohol. Instead they purchase it from restaurants or hotels that have import licenses with a fee paid to them known as Hotel Charge or Handling Fee. This means it's cheaper for the client than having their own licence, and the group with the licence make some extra money.

The Hotel charge feature is enabled on the system from Location Setup and it directly becomes a part of a product’s costing i:e when we use that in a recipe the cost added is NET+ Hotel Charge which is different than our UK or ROW Clients.

The percentage of Hotel Charge can vary, i: e Ruya Dubai doesn’t have the same handling fee as Billionaire Mansion (it depends in the area the restaurant is in).

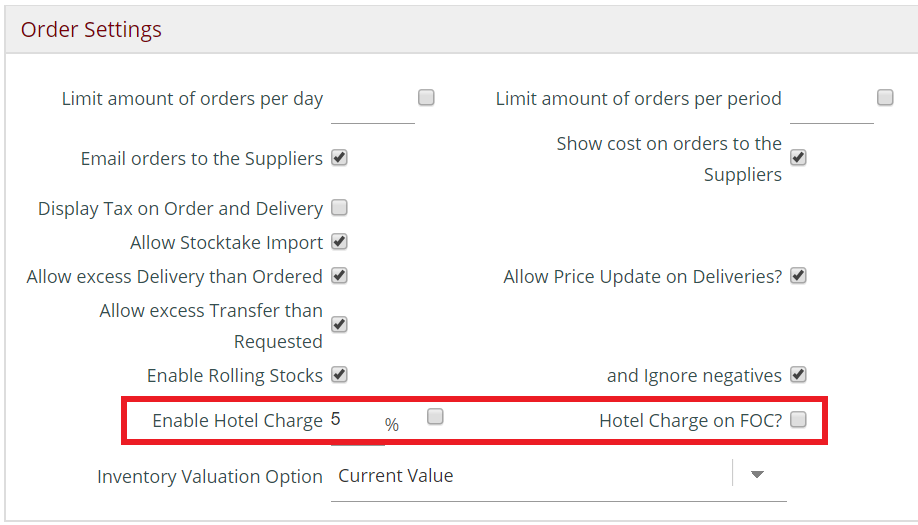

Enabling Hotel Charge on STO

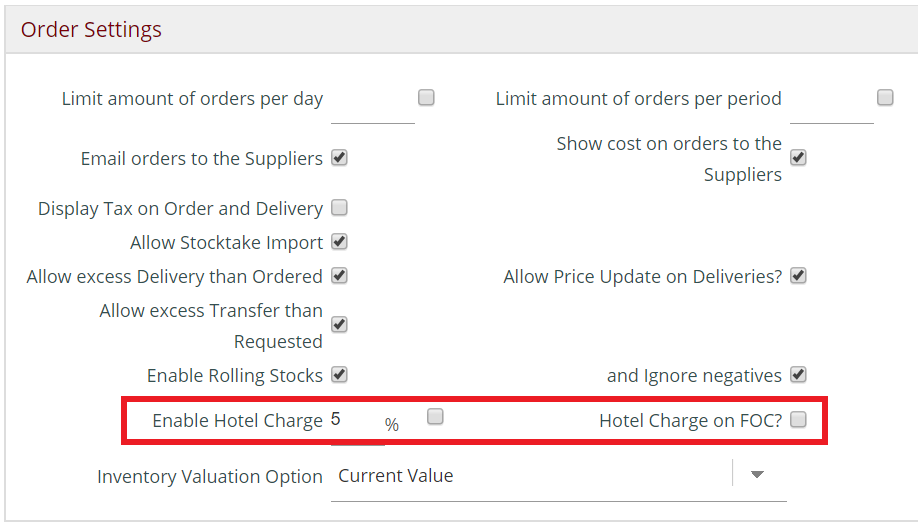

- We need to click on Setup > Location Setup > Tick the Hotel Charge Box and enter a percentage.

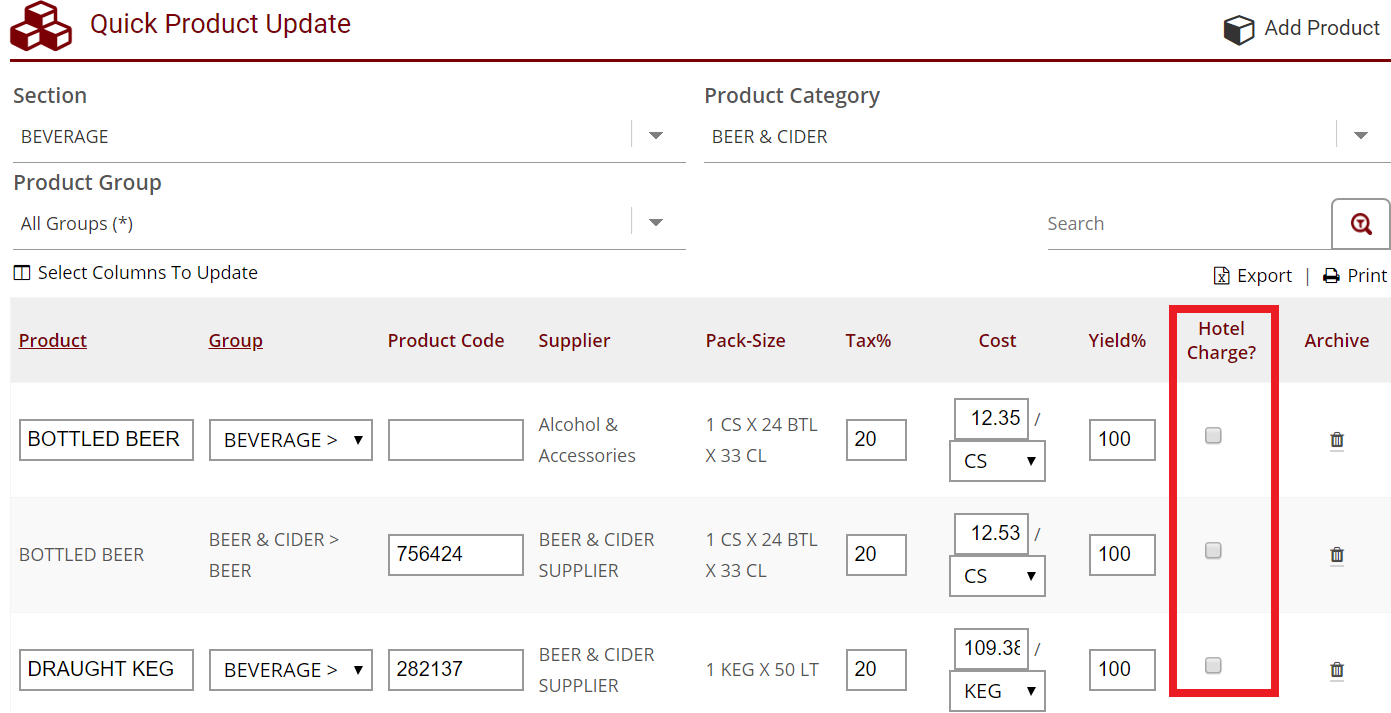

- Once this is done, we need to click on quick update and then tick the hotel charge box in all alcoholic products.

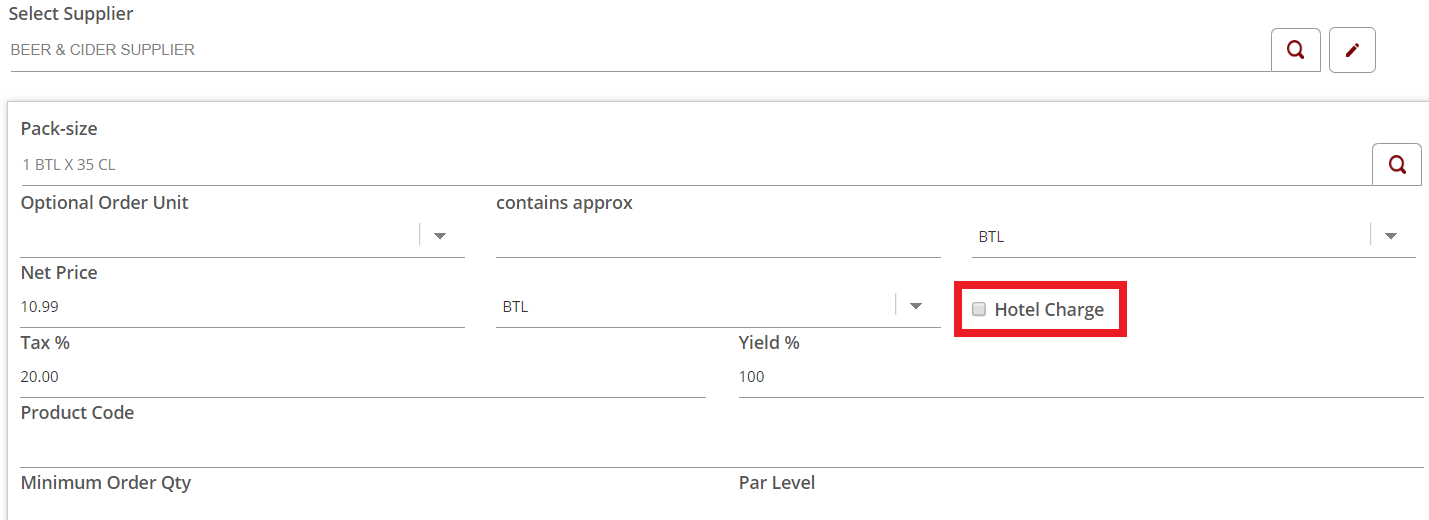

- You can also add this option on the product edit page.

Analytics

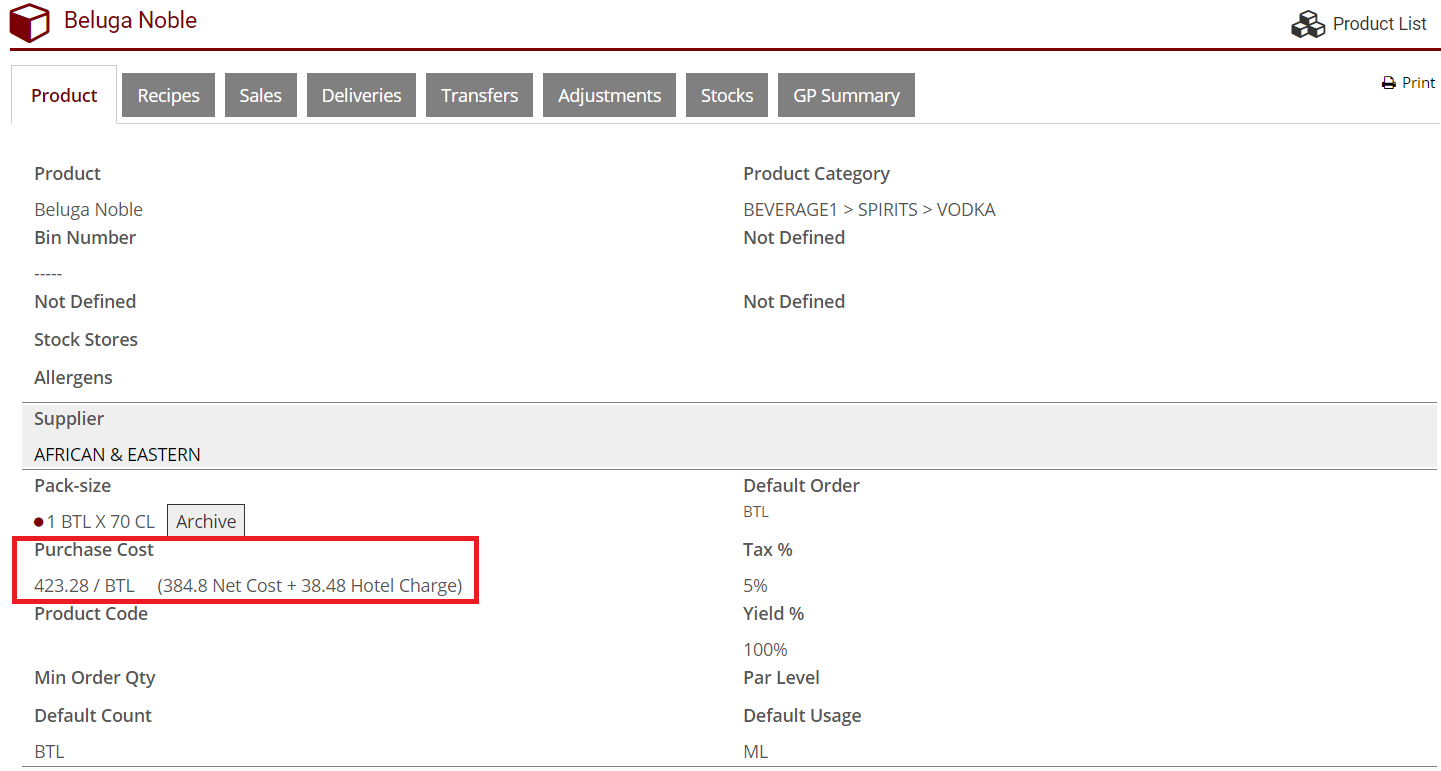

Let’s take an example of Beluga Noble, the NET price of the product is AED 384.8 and the handling fee is 10% (38.48) - the total cost that is paid by the restaurant excluding the VAT is (384.8 + 38.48) 423.28.

- If a recipe is added for this product, the ingredient cost becomes AED 423.28 per BTL.

Reports will follow the same procedure, taking the total of the item including Hotel Charge as the cost of the product.

Orders & Deliveries

Hotel Charge is calculated automatically while placing an order and it appears separately at the Accepting Deliveries stage so that the client is clear on their costs.

Hotel Charge on FOC [Free of Charge] Products

The additional option on the Location Setup page called Hotel Charge on FOC? will set the system so that when items are delivered at zero cost (FOC), Hotel Charge will still be applied and the client will still incur a cost.

- For example: If the supplier decides to give 5 Beluga Noble bottles free of charge then we need to accept them at zero price, however; the handling fee will be applied on that purchase order according to what the client needs to pay.

This also means that reports will state a cost (the hotel charge) for FOC items.

Import Sheets

This is one of the most important parts of a setup in Dubai because sometimes the clients themselves aren’t aware whether the product information they shared is including the handling fee or not. This information must be double checked before products are imported.

- If the hotel charge is included in the NET prices shared by the client we’ll need to separate them using a formula in the sheet.

- If a product costs AED 115 to a client and the client pays a 15% handling fee for alcoholic beverages then we need to deduct 15% out of it and put it in a separate column on the import sheet.

It is essential to know the Hotel Charge percentage before moving forward with an upload or any price changes, and to have that information in writing to refer back to later in the event of any problems.

Comments

0 comments

Article is closed for comments.