Update - VAT Changes in UK Follow

VAT Changes in UK

Considering the recent news for the UK VAT, you will have to make specific changes to both your STO and EPOS.

- The new UK VAT rate will be effective from 1st April 2022.

Steps for updating VAT on STO: -

For changing VAT in an individual or group of recipes on STO: -

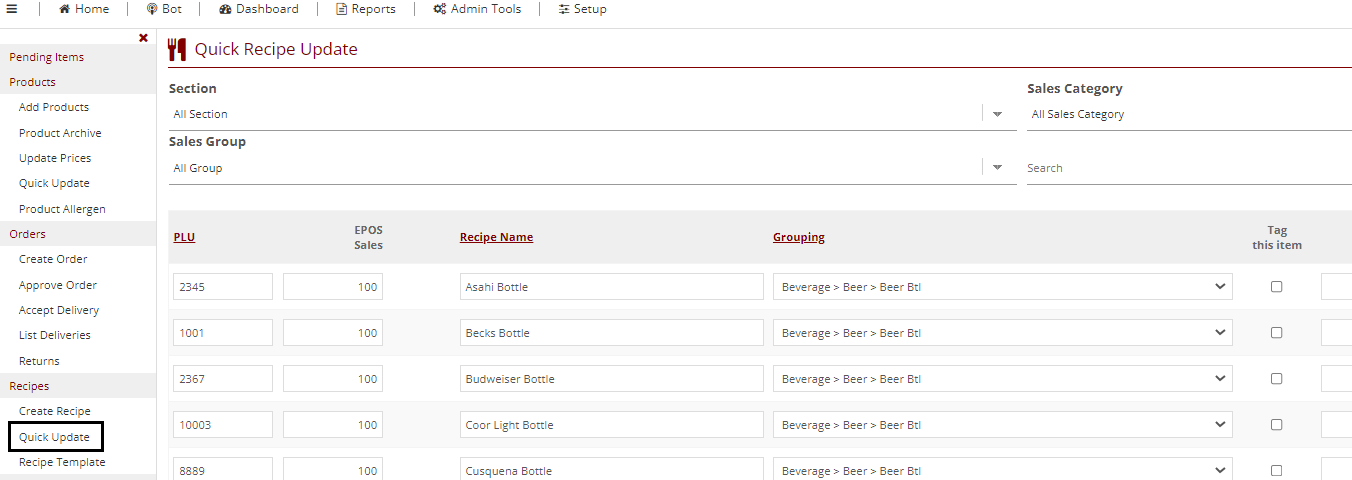

- Go to Quick Update under the header Recipes on the left panel of the home page.

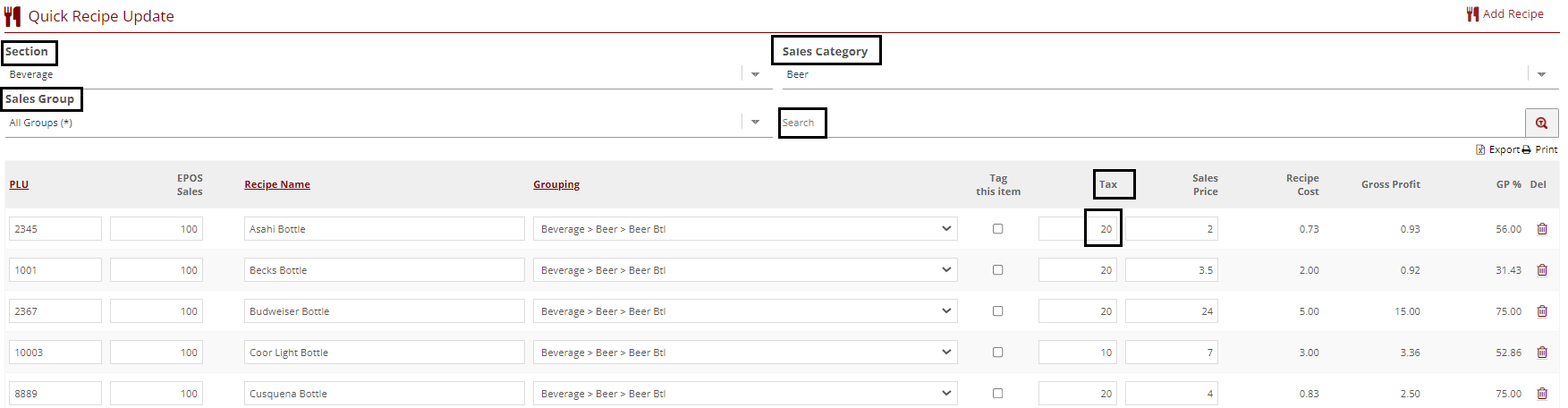

- For updating VAT, change the value under the header Tax. All the changes done on this page will be saved automatically.

As an example, we have selected Beverage in the section & Beer in Sales Category (keeping All Groups for Sales Group). This will show all the recipes under Beverage>Beer for an entire sales group. You can now just update the tax value for the recipes.

For any query or more information on this, please contact STO Support Team.

Comments

0 comments

Please sign in to leave a comment.